If you want to know where the action in franchising is, check out the top 10 franchise trends for 2026.

For starters, the franchise industry is evolving fast.

Next, you may not know this, but I’ve been writing about the latest franchise trends for years. And I know that what worked 5 years ago won’t cut it in 2026.

That’s because franchise trends are shifting toward leaner models, smarter technology, and recurring revenue.

In addition, capital remains expensive. Buyers are cautious. Regulation may be tightening again. Or not. It depends on the mood in Washington.

With those things in mind, smart franchisors are adapting. They’re building businesses around these realities, not fighting them.

After all, they want to attract new franchisees in 2026.

Key Takeaways About the Top 10 Franchising Trends for 2026

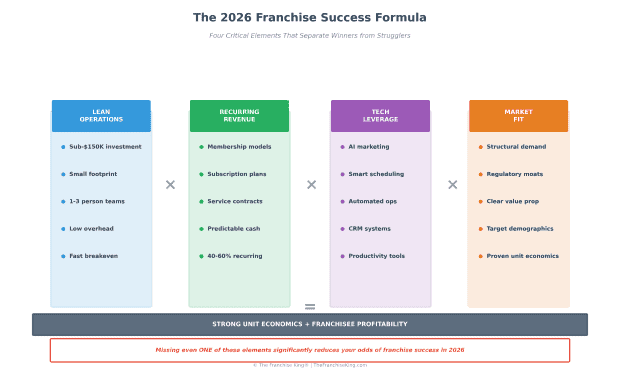

The franchise landscape in 2026 favors operators who understand that success comes from lean operations and recurring revenue models.

Capital remains expensive, regulation is tightening in key sectors, and technology is making human operators more productive, but not replacing them. Smart buyers will recognize that the winning concepts are already built around these realities.

In addition, asset-light franchises under $150K, regulated-service models, and skilled trades with professional branding represent the strongest opportunities.

Next, when it comes to franchise industry trends, membership-driven revenue, climate-resilient services, and AI-enhanced operations are shifting from competitive advantages to baseline expectations. If you’re evaluating opportunities in 2026, these aren’t optional features…they’re requirements.

Finally, the consolidation trend and institutional capital flowing into franchising signal a maturing industry. This creates both opportunities and risks for franchisees depending on how buyer firms approach their investment.

Tip: If you’re a franchisee, you need to talk to your franchise lawyer about what can happen to you if an equity firm buys your franchisor in the future. Or, anything else that may impact your local franchise business.

That means that your job as a franchise buyer is to identify concepts that embody these trends while maintaining strong unit economics and genuine franchisee profitability.

Here are the top franchise opportunities for 2026

Winning in 2026: The Latest Franchise Trends

The winners in 2026 will be the franchise concepts designed for today’s market…from day one. And the franchisees who can capitalize on them.

To that end, this isn’t about marginal improvements to old models. It’s about fundamental shifts in how franchises operate, who buys them, and what makes them successful.

It all boils down to this:

If you’re researching franchise opportunities in 2026, these trends will shape what you see in the market.

So read on, while I share the top 10 franchise trends that matter most heading into 2026.

Franchise Trend #1: Asset-Light Franchises With Sub-$150K All-In Costs

Capital remains expensive and younger buyers are generally debt-shy.

That being said, franchises that can be opened for $150,000 or less are poised to dominate new-unit growth. This includes everything from build-out to working capital.

That’s why home-based and mobile concepts are leading the way. Think:

- Cleaning

- Restoration

- Pet services

- Home organization

- Tutoring

- B2B services

- Mobile med-spa

- Mobile fitness

Micro footprints are another path.

These are 400 to 900 square foot kiosks, modular pods, and ghost-kitchen-plus-pickup windows instead of full-service, capital intensive restaurants.

In addition, shared or flexible space is becoming common.

Co-retail, co-kitchens, clinics inside gyms, mini-salons, and concepts embedded in coworking or wellness hubs all fit this model.

Finally, these franchise models are designed for a solo owner-operator plus one or two flex workers, not large staffs.

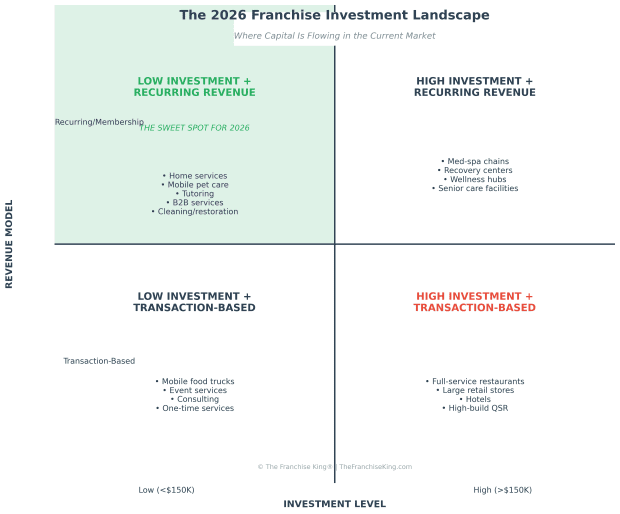

The 2026 Franchise Investment Landscape

The Top 10 Franchise Trends for 2026 #2: Regulated-Services Franchises: Healthcare, Education, and Compliance-Heavy Niches

In 2026, regulation will increase in health, eldercare, education, and building standards.

And in our current “always-changing their minds” Administration, that complexity favors organized systems over independents. let’s take a look at some of these regulatory trends that will affect the franchise space.

- In senior and healthcare, non-medical in-home care faces tighter state oversight around training, data security, and documentation. Niche clinics are expanding in PT/OT, speech, behavioral health, women’s health, metabolic health, and sleep disorders. At-home medical services like blood draw, lab logistics, and remote monitoring support are integrating with telehealth.

- Education and skills training is another hot zone. Tutoring and enrichment brands must comply with data privacy and AI regulations for minors. STEM/robotics, test prep, college readiness, and adult digital-skills and upskilling programs with structured curricula are growing.

- Building and environment services are seeing demand surge. Energy audits, EV-charger installation and maintenance, IAQ (indoor air quality), and mold and radon testing are all expanding. ESG and compliance support for SMBs and property owners is becoming standard.

In addition, watch for franchisors hiring compliance officers, clinical directors, and education directors early.

And know this: today’s franchise systems are investing heavily in training, documentation, and audit-ready processes. Embedded partnerships with hospitals, insurers, school districts, and municipalities are becoming critical.

To summarize this section on the regulatory franchising trends for 2026, any space that’s compliance-heavy and recurring tilts toward franchise systems. The brand becomes what I call a “compliance shield” for local owners.

Did you know you can start a franchise business with the E2-Visa program. Read more.

Let’s Continue with Top 10 Franchise Trends For 2026

2026 Franchising Trend #3: AI-Enhanced but Human-Delivered Service Models

AI won’t be replacing most frontline franchise roles in 2026.

But it’s quietly powering marketing, scheduling, pricing, and customer management. Let’s get into some specifics.

- AI-driven local marketing is changing the game. Central systems create localized ad copy, SEO content, and budget allocation for each territory. Automated tracking and optimization of lead sources and campaigns is becoming standard.

- Smart operations use AI for staffing suggestions based on weather, events, and historical demand. Inventory and purchasing recommendations help food, retail, med-spa, and wellness operators stay efficient.

- AI co-pilots for franchisees are emerging. Internal chat tools answer system questions using manuals, training, and policies. They provide scenario guidance for handling complaints, pricing, hiring, and B2B pitches.

- Customer-facing personalization is improving. Personalized workout, learning, or care plans are generated by AI but delivered and maintained by humans. Smarter loyalty programs offer tailored offers and retention sequences.

FYI: Franchisors will be selling “AI-powered marketing” and “AI ops support” as key differentiators in their franchise sales story.

Love pets? This under-the-radar franchise checks every box — low investment, franchisee support that's unheard of these days, and an opportunity most people never even get to see. Don't walk past this one. Click Here Now!

FDDs and manuals now include data governance and AI-use policies, especially in healthcare and youth sectors. And vendor ecosystems around CRM, marketing automation, and scheduling are built into the franchise, not optional bolt-ons.

Finally, the winning franchise business concepts in 2026 won’t be silly and never going to happen “AI franchises.”

Instead, they’ll be human franchises with AI leverage that makes the owner and staff far more productive than local independents.

Franchise Trends for 2026 – #4: Recovery, and Bio-Optimization Franchises

The business of wellness is maturing way beyond generic fitness and spa services.

Healthspan, performance, and measurable outcomes are taking center stage. Preventive care and recovery are gaining traction with consumers, employers, and eventually payers. For instance:

- Recovery and performance centers are stacking services. Infrared saunas, cold plunge, compression, red light, and hyperbaric oxygen are offered in tiers. These centers integrate with sports teams, gyms, physical therapy, or corporate wellness programs.

- Metabolic and longevity programs are expanding. Clinic-backed weight management and metabolic health programs with medical oversight are growing. Wearable-driven insights combine with coaching, lab work, and supplement protocols.

- Women’s health and midlife services are finally getting attention. Menopause support, hormone and metabolic optimization, pelvic floor care, and pre/post-natal and postpartum recovery are all growing categories.

In addition, membership-driven models are practically becoming the industry standard. Recurring revenue is the core, with monthly plans replacing one-off sessions.

What to Watch For in the Wellness Space in Franchising in 2026

You need to watch for concepts identifying as “healthspan centers” or “performance labs” instead of spas or salons.

Next, more than ever, the documentation of outcomes matters now.

Things like, before/after metrics, performance markers, and customer-reported results are being tracked.

Plus, growing integration with healthcare providers, payers, or HSA/FSA-eligible offerings is happening where regulations allow.

In summation, the franchise brands that can demonstrate real, trackable improvements will enjoy strong pricing power and potentially more loyal membership bases. As in, lower member drop-off rates.

2026 Franchise Industry Trend #5: Blue-Collar Gold 2.0. Skilled Trades + Technology + Professional Branding

A continuing shortage of skilled trades and an aging housing stock are driving demand.

That’s why professional, tech-enabled service brands that can reliably handle home and facility needs are winning. Here are a few examples of what I mean:

- Electrification and energy work is booming. Panel upgrades, EV charger installs, heat pumps, and energy-efficiency retrofits are in high demand. Smart-home upgrades are now being bundled with traditional electrical or HVAC work. Smart.

- Resiliency and property performance services are growing. Storm-hardening, roofing improvements, siding and window upgrades, insulation, and sealing/weatherization are all expanding. And specialized floor coatings, garage and warehouse optimization, and commercial facility maintenance round out this category.

- Niche exterior services are emerging. Solar panel cleaning and maintenance, roof rejuvenation, soft-wash exterior cleaning, and gutter protection are all franchise-ready.

- B2B-oriented trades are thriving. Light industrial and commercial maintenance, specialty cleaning for labs, healthcare, and food service, and recurring facility services are strong performers.

- Franchisors are emphasizing routing apps, CRM, quoting and estimating tools, and automated review generation. Heavy recruitment and training systems help franchisees build reliable technician teams. Brand positioning is geared toward white-collar buyers who manage blue-collar crews through systems, not personal trade expertise.

In summary, trades and home-services franchising will continue to be a cash-flow engine. Winners operate like organized tech-enabled companies, not simple “guy with a truck” businesses.

2026 Franchise Trend #6: Smaller Footprint Food: Specialty, Automation, and Off-Premise First

(Image courtesy of Peach Cobbler Factory’s Instagram page)

Increased labor pressure, food inflation, and rent costs continue to reshape food franchising.

The shift is toward smaller spaces, simpler menus, and off-premise-centric operations.

With those things in mind, here are some of the specific food franchise trends for 2026.

- Micro-format, specialty concepts are multiplying. These are 400 to 800 square foot units focused on a narrow product: coffee, bowls, smoothies, desserts, or a regional street food offering. Kiosks and modular units are appearing in nontraditional venues like airports, hospitals, campuses, offices, and dealerships.

- Automation is being deployed where ROI is clear. Automated beverage, coffee, portioning, and fry stations reduce labor and waste. Limited robotics handle repetitive, high-volume items like pizza, salad, fries, and some assembly tasks.

- Off-premise and digital operations are becoming the priority. Layouts are optimized for drive-thru, pickup windows, and cubby systems, not large dining rooms. First-party apps and loyalty programs integrate with third-party delivery platforms.

- Watch for FDD data showing lower labor as a percentage of sales and smaller footprints as the norm. Brands are offering multiple formats: ghost kitchen, inline, kiosk, and drive-thru-only. Menus are being engineered to travel well, simplify operations, and support partial automation.

Bottom line?

Concepts that demonstrate strong AUVs out of small boxes with lean labor will pull capital from sophisticated multi-unit operators and institutional investors.

2026 Franchise Business Trend #7: Portfolio Franchisees and Consolidation: Franchisees as Micro-PE

Some experienced franchisees are starting to act like micro private equity funds.

Namely, they’re assembling portfolios of brands and leveraging shared back-office infrastructure. And franchisors are designing themselves to plug into these portfolios. Check it out.

- Multi-brand local clusters are forming. One operator may control complementary brands across a metro. This might include cleaning, lawn, pest, and handyman services. They share a call center, HR/payroll, bookkeeper, and marketing team.

- Cross-selling ecosystems are being built deliberately. Wellness clusters combine fitness, med-spa, nutrition, and recovery. Senior clusters bundle in-home care, home modification, transportation, and downsizing/move management.

- Succession and roll-ups are accelerating. Strong territories are transitioning from first-generation owner-operators to portfolio buyers. Multi-unit operators are using acquisitions, not just new builds, to expand.

- FDD language and Discovery Days are increasingly targeting existing multi-unit and multi-brand operators. Franchisors are centralizing vendor programs, marketing, and call centers to make it easier to scale. Larger franchisee groups are trying to negotiate portfolio deals across multiple brands under one platform.

What Does This All Mean?

In a nutshell, the “professional franchisee” class is growing.

New entrants must either compete by being hyper-local, hands-on operators in niches, or intentionally build their own small portfolios to benefit from scale.

The Top 10 Franchise Trends for 2026 #8: Climate-Resilient “Rescue & Repair” Franchises

Severe weather, aging infrastructure, and tighter insurance economics are driving demand.

That’s one the reasons damage prevention, fast recovery, and property hardening services delivered by organized franchise brands are going to thrive in 2026. The details:

- Disaster-response and restoration services are evolving. Water, fire, and mold players now also manage contents inventory, digital documentation, and adjuster communication. And now, priority-response contracts with HOAs, commercial landlords, hospitality groups, and municipalities are becoming standard.

- Climate-resilience services are emerging as a category. Flood mitigation includes drainage, sump pumps, grading, and barriers. Wind and storm hardening covers impact windows, shutters, and roof reinforcements. Wildfire-risk reduction includes specialized services that provide defensible-space clearing, ember-resistant vents, and some of the newer roof/gutter treatments that are starting to become available.

- Next, insurance-aligned operations are critical. Brands are positioning as fluent in carrier systems, Xactimate/estimating tools, and claims documentation.

- Marketing that uses “resilience,” “hardening,” and “disaster-ready” language rather than simple “cleanup” will be more common. In addition, preferred-vendor status with insurers, property managers, REITs, and national accounts is quickly becoming the norm. In 2026, service plans will bundle inspections, minor maintenance, and rapid-response commitments.

In short, where you find property damage, urgency, and insurance complexity, franchising can scale. Strong operators will turn episodic events into recurring relationships via annual service contracts.

2026 Franchise Trend #9: Membership-First “Everything-as-a-Subscription” Local Services

In some franchise sectors, subscription thinking is now practically standard.

Local service franchises will be transformed into recurring revenue models not just single transactions. Check this out:

- Membership-driven models are appearing everywhere. Auto services offer maintenance plans, detailing memberships, and “unlimited wash plus perks” bundles. Home services sell multi-service seasonal bundles: lawn, pest, window, gutter, and HVAC tune-ups. Pet services offer daycare passes, grooming clubs, and wellness memberships. Beauty and wellness sell med-spa plans, barbershop/salon subscriptions, and recovery memberships.

- Tiered structures will become more sophisticated. In 2026, multiple membership levels will offer varying access, discounts, and priority booking. Founding-member drives will lock in recurring revenue before or immediately after franchise grand openings.

- Retention science is continuing to be applied systematically. Centralized analytics track churn, lifetime value, and upsell pathways. Playbooks in 2026 will cover at-risk member outreach, win-back offers, and referral incentives.

- 2026 franchise sales narratives will now highlight percentage of revenue from memberships and LTV, not just sales volume. In-store scripts and processes will be designed around converting walk-ins into recurring members. Systems will be built to support semi-absentee ownership via predictable, subscription-driven cashflow.

Finally, recurring revenue models support higher valuations and more stable cash flows. But they require strong sales and retention skills at the franchise unit level.

A Bit More on Semi-Absentee Franchise Trends and Opportunities in 2026

Lots of semi-absentee franchise opportunities will enter the picture in 2026. That’s good news. However, before franchise buyer’s get too excited about owning a “semi-absentee” franchise, they’ll need to confirm the opportunity being presented is truly semi-absentee.

For example, is the business opportunity semi-absentee after a few years of operating profitably? Or, is it semi-absentee from day one, like Great Clips?

Note: The best way to find out how “semi-absentee” a franchise really is, is to ask the franchisees.

And if you’d like to find out how much money franchisees are making a year, use the techniques I teach in my super-helpful eBook:

2026 Franchise Industry Trends #10: More Investment Firms Buying Franchisors and Building Brand Platforms

Institutional and quasi-institutional capital is increasingly buying franchisor entities. And I’m not convinced it’s a good thing.

That’s because when an investment firm buys a franchisor, it’s generally good for the franchisor’s valuation, the founder’s wallet, and good for the investors. But the results can be mixed for franchisees.

Let’s dig into this important franchise trend for 2026.

- If the firm views the franchisees as partners and invests in their profitability, the entire system rises. However, if the firm views the franchisees merely as a source of recurring revenue to be squeezed for a quick exit, the brand equity can be eroded, leaving franchisees with lower margins and a damaged culture.

- Private equity, family offices, and investment platforms aren’t just buying multi-unit franchisees anymore. They’re buying the franchisors themselves. Franchising is being treated as a scalable asset class.

- Multi-brand platforms are forming. One holding company owns several concepts in a vertical: home services, wellness/beauty, or children’s enrichment. They share technology, development teams, vendor contracts, training, and support structures.

- Earlier-stage acquisitions are happening. Brands with 20 to 300 units are being acquired sooner in their lifecycle. Founders are staying on as brand presidents or chief concept officers under a larger umbrella. Will they stay on? Who knows.

- Professionalization is accelerating. More franchisor-side executives have PE, consulting, or public-company backgrounds. There’s stronger focus on metrics: same-store sales, unit economics, franchisee profitability, CAC, and churn.

Some Thoughts on Private Equity Firms Buying Franchise Companies From Franchise Industry Professionals

I asked a few franchise industry people to weigh in on this huge trend in franchising for 2026. Here’s what they told me:

“I have to say that it is a mixed bag. Remember you cannot discount the PE business model when making this determination because they are after all, simply Fix ‘n Flip guys. So what happens is that once the brand is acquired, the internal operations are necessarily streamlined and shared resources become a key component of management. There is always one ‘anchor tenant’ and almost always the ‘weird acquisition’ that doesn’t make complete sense. At first there is a buying spree, but soon one realizes that they ‘shed’ brands that simply don’t fit. Overall, is it a good thing? Yes I think it is for the most part…but of course you get good PE guys and you get bad PE guys. Such is life.”

– Sean Goldsmith, Groe Global

“Some of the platform companies strive to add value to the franchise investment in each of their portfolio companies. Those that understand franchising do an outstanding job. However, of late, others are not as competent in franchising and franchise management and that is creating significant problems. Leveraging supply chains, management, headquarters and field support are opportunities some of the platform companies have not understood in keeping their investments separate. That lack of understanding negatively impacts their investment’s value.”

– Michael Seid, MSA Worldwide

“The power of franchising comes from franchisors and franchisees managing to reconcile their competing self-interests enough to form a win-win situation. Add in a third self-interested party like, say, a parent company and that win-win-win becomes even less probable.

Add in two more powerful parties, like a purse-string-holding investment firm and their shareholders, and the likelihood that franchisees will survive, much less thrive, what now must be a win-win-win-win-win relationship becomes highly unlikely.”

– Sean Kelly, UnhappyFranchisee.com

“Private equity can be a genuine force multiplier for franchise brands when executed thoughtfully. I’ve seen PE capital enable responsible expansion, strengthen operational infrastructure, and provide resources that founders simply couldn’t access alone. When PE firms approach franchising with humility and a willingness to learn the unique dynamics of the franchisor-franchisee relationship, the results can benefit everyone in the system.

The problem is that this is frequently not what happens.

Too often, PE management teams arrive without meaningful franchising experience, and more troubling, without the willingness to acquire it. They apply traditional private equity playbooks to a business model that fundamentally depends on alignment between franchisor and franchisee. The result is predictable: aggressive unit growth targets that prioritize capital deployment over market readiness, debt structures that create fragile systems, and decision-making that shifts risk downstream to the franchisees who can least afford it.

I’ve watched this pattern unfold repeatedly, most recently with TGI Fridays, Hooters, Fat Brands, Xponential. The strategy looks brilliant on paper until market conditions expose its fragility. And when these systems crack, it’s the franchisees caught in the middle who pay the price.

What I tell prospective franchisees is this: PE ownership is neither automatically good nor automatically bad. But it demands unprecedented diligence. Ask hard questions about debt levels, growth mandates, and exit timelines. Understand whether the PE firm has invested in learning franchising or is simply applying financial engineering to a relationship-driven business.

The franchise model works when everyone’s interests align. When PE prioritizes quick exits and leveraged returns over sustainable system health, that alignment breaks and so does the promise of franchising.

– Schuyler ‘Rocky’ Reidel, Managing Attorney, Reidel Law Firm

More quotes:

“Private equity’s growing role in franchising brings both validation and risk: while it has helped elevate franchising’s credibility by attracting capital, talent, and attention to a proven, scalable model, its short-term focus on ROI often conflicts with the long-term nature of franchise agreements and relationships. Most private equity firms operate on three- to five-year exit timelines, while franchisees commit for ten years or more, creating misaligned incentives that can lead to decisions prioritizing resale value over system health. This raises fundamental questions about brand stewardship under private equity…whether brands are guided by experienced operators who understand the realities franchisees face, or by financial committees removed from day-to-day business ownership.

Furthermore, when cost-cutting, aggressive growth, or fee increases erode trust and support, franchisees are often left dealing with the consequences long after a private equity exit. The contrast with earlier eras of franchising, when founders like Bud Hadfield, Fred DeLuca, and Anthony Martino built long-term, relationship-driven systems, highlights what can be lost. This isn’t an argument against private equity, but a call for balance—because franchising was never meant to be a flip; it was meant to be a long-term partnership built on trust.”

– Paul Segreto, Acceler8Success America

Here Are More Thoughts on This Important Franchising Trend

“We do have companies listed on our stock exchange which are multi brand franchisors and they have not been a spectacular success. They have tended to buy major brands at huge multiple’s of earning using shareholder and borrowed funds. (Sound familiar?) Franchisee is then asked to pay the price of the acquisition via decreased margins on items bought from the franchisor, reduced support, and sometimes dubious charges to the ad funds etc. Any extra profit made through efficiencies at Head Office simply go to shareholders. There seems to be little in this approach for franchisee. The strategy nearly bankrupted Retail Food Group here. I would not buy into this type of ownership structure.”

– Grant Garraway, Australia, Expert Franchise Consultant

“The real question is: when has private equity truly added real value, not artificial, to a sector? If one genuinely believes that private equity improves customer experience and strengthens community, then yes, PE can be great for franchising.”

– Slava Borisov, Puptqe

“The ongoing buying spree of franchisors by investment firms is a bit of a double-edged sword. On the good side, institutional capital can professionalize systems, strengthen unit economics, and fund better support, technology, and infrastructure. On the flip side, when the focus shifts too far toward short-term financial gymnastics…higher fees, rushed growth, and trimmed support. It’s usually the franchisees who feel it first. The healthiest outcomes happen when investors play the long game and stay aligned with brand integrity, franchisee profitability, and leadership that actually cares. From a buyer’s standpoint, prospective franchisees should also make sure they’re talking with owners or founders who have real skin in the game—not just well-trained sales guns living on commission and caffeine—so they can hear the unfiltered truth about where the brand is headed.”

– Paul Dorsey, CEO of Jantize America

“It depends whether they know anything about the core business sector or franchising or are prepared to pay to get proper sector expertise. I have heard stories about some that simply do don’t do either and it’s a recipe for disaster. If done properly I think it’s a good thing.”

– Joel Bissitt, Group CEO, Infinity Franchise Group

“Private equity buying franchisors isn’t inherently good or bad — it shifts the center of gravity. Institutional capital can improve systems, discipline, and scale, but without mature governance, strong franchisee voices, and reinvestment back into the field, growth becomes spreadsheet-driven instead of operator-driven. The franchisors that win long-term remember that franchisee profitability and trust — not just valuation or exit timelines …are the real assets.”

– John W. Francis, Johnny Franchise

“I think some franchisors are looking for it to help scale. With PE they get a huge influx of resources to scale at a speed that they normally couldn’t. Two, I think PE is looking for “proven” investments. By proven, I mean a business that has a track record for scaling and doing well. They see a franchise that’s doing well and believe they can come in with said resources and beef it up quickly to turn around and sale in a few years.”

Bryant Howell, Franchise Coordinator, D1 Training

“Private equity buying a franchise company is like buying the factory where you work—not because they care about what you make, but because they like the cash it throws off. Same job, same people, more rules, fewer resources, and a stopwatch suddenly appears. If the numbers hit, you’re “optimized.” If they don’t, you’re expendable.”

– Jeff Nave, Franchise Restaurant Fixer

Bonus: More Top Franchising Trends for 2026: These are Related to Investment Firms Buying Out Franchisors

In 2026, you’ll want to watch for frequent announcements of recapitalizations, roll-ups, and strategic investments across franchise verticals.

Next, look for “House of brands” platforms becoming more visible at franchise conferences and in industry media. And 2026 FDD changes are going to reflect new parent entities, stronger Item 19s, and more ambitious growth plans.

What does this mean?

For franchisees, this means potential benefits like better systems and bigger marketing budgets. It also means risks like tighter controls, rising fees, and faster system changes.

For franchise company founders, there’s a clearer build-to-sell path if they can demonstrate a strong concept with reliable unit economics.

That’s because they won’t be able to unsee dreamy images of a potential 7-figure check being handed to them by investment bankers.

For investors, there are more franchise platforms and roll-up strategies. Franchising is becoming increasingly treated like an institutional asset class.

What These 2026 Franchise Trends Mean for You

The franchising trends I shared with you here aren’t predictions. They’re patterns already forming.

Simply stated, the franchise industry in 2026 will favor lean models, recurring revenue, and professional operations.

In particular, fast-changing technology will make human operators more productive. Regulation will favor organized systems. Capital will flow to concepts with proven unit economics.

So, if you’re evaluating franchises, look for these characteristics. They signal business concepts built for current market realities, not past conditions.

Bottom line?

The best franchise opportunities in 2026 will be the ones that already embody these trends.

I encourage you to take what you’ve just learned and run with it!

FAQ’s

Asset-light franchises require minimal physical infrastructure—think home-based services, mobile operations, or micro-footprints under 900 square feet. They matter because capital is expensive and younger buyers are debt-averse. Lower total investment means faster breakeven and less financial risk.

AI powers the back-end operations—marketing automation, scheduling optimization, pricing algorithms, and customer management. It’s not replacing your technicians or trainers. It’s handling repetitive tasks so human operators can focus on service delivery and customer relationships. Think AI co-pilot, not AI replacement.

It depends on their approach. PE ownership can bring better systems, bigger marketing budgets, and professional management. It can also mean tighter controls, rising fees, and pressure to maximize short-term revenue. Before buying into a PE-owned system, talk to existing franchisees about how the transition affected their operations and profitability.

Like i said, ask the franchisees directly. Find out if the business is truly semi-absentee from day one or only after several years of hands-on operation. Request specific time commitments in hours per week. Get details on what management structure makes absentee ownership possible. If the franchisor can’t provide clear answers backed by current franchisee validation, that’s your red flag.

If you’ve read any of my other franchise trend pieces, trends are driven by structural market forces, demographics, regulation, technology costs, capital availability. Fads are driven by temporary hype. Asset-light models exist because capital is expensive. That’s structural. A specific superfood or workout craze? That’s a fad. Focus on concepts built around lasting market realities.

About the Author

The Franchise King®, Joel Libava, is a leading franchise expert, author of "Become a Franchise Owner!" and "The Definitive Guide to Franchise Research." Featured in outlets like The New York Times, CNBC, and Franchise Direct, Joel’s no-nonsense approach as a trusted Franchise Ownership Advisor helps aspiring franchisees make smart, informed decisions in their journey to franchise ownership. He owns and operates this franchise blog.

Note: When you buy through links on this website, we may earn an affiliate commission.