Although franchise bookkeeping may not be the most exciting part of being a franchisee, it’s necessary!

I’m talking about managing taxes and accounting. Tasks that might not be your strong suit.

But that’s okay – you can always seek help with your franchise accounting from a Certified Public Accountant (CPA).

But how exactly can a CPA support your franchise business?

We’re here to break it all down, so sit back, read and learn.

How a CPA Can Help with Franchise Bookkeeping: Tax Compliance

As a franchise owner, you must follow both state and federal tax laws. A CPA helps you understand these rules and ensures that your tax returns are accurate.

By working with a CPA, you will avoid costly mistakes. They keep track of deadlines so you don’t miss filing dates. A missed deadline can lead to penalties, which can hurt your cash flow. A CPA also ensures you take advantage of any available tax credits and deductions to lower the amount you owe.

Additionally, a CPA can represent you if the IRS or state authorities audit your franchise. They can answer questions and provide the right documents. This support can save you lots of time.

Strategic Financial Planning for Franchise Growth: A CPA Can Help

Strategic financial planning is key to growing your franchise. A CPA can guide you through this process by analyzing your business’s current financial status and helping you set realistic goals.

Love pets? This under-the-radar franchise checks every box — low investment, franchisee support that's unheard of these days, and an opportunity most people never even get to see. Don't walk past this one. Click Here Now!

They can also help you understand your cash flow and where to allocate resources. They will show you how to budget for new locations or expansion projects. This prevents you from overspending or running into cash shortages. It’s all part of bookkeeping for your franchise business.

Additionally, a CPA familiar with franchise accounting can also forecast your future franchise business revenue and expenses. This allows you to prepare for potential challenges and opportunities. Their insights help you adjust your strategy as needed so you stay on track.

Finally, when you work with a CPA, you gain a partner who knows how to make your money work harder. They can spot risks before they become big problems, so your franchise remains stable during its growth phase.

Franchise Bookkeeping: Navigating Franchise-Specific Accounting Standards

As a franchise owner, you must follow certain rules that apply only to franchises. These standards ensure that your financial records are accurate and meet industry requirements.

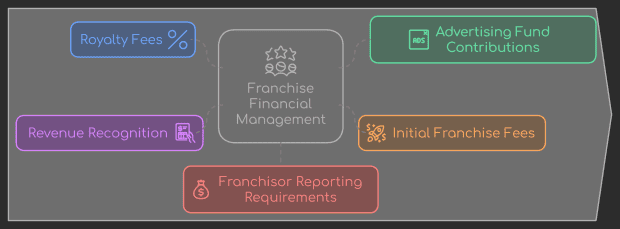

Here are some common franchise-specific bookkeeping and accounting standards.

- Royalty fees: Franchises often pay a percentage of sales as royalties to the franchisor. A CPA familiar with franchise accounting ensures these are recorded correctly.

- Advertising fund contributions: Franchises usually contribute to a shared advertising fund. A CPA tracks these contributions and ensures accurate reporting.

- Initial franchise fees: When you start a franchise, there are upfront fees to account for. A CPA knows how to manage them properly.

- Revenue recognition: Franchises need to recognize revenue accurately based on agreements with the franchisor. A CPA ensures this process follows accounting rules.

- Franchisor reporting requirements: Franchisors often require specific financial reports. A CPA prepares these reports correctly and on time.

By handling these standards, a CPA helps you avoid mistakes that could lead to audits or fines. They ensure your financial records are always in order.

Risk Management and Financial Forecasting

A CPA helps you handle both risk management and financial forecasting. By doing this, they help you make better decisions for your franchise business.

Here’s how a CPA assists with risk management.

- Identifying financial risks: A CPA spots risks like cash flow issues or overspending early.

- Creating contingency plans: They help you plan for unexpected expenses so your business can handle surprises.

- Reviewing insurance coverage: A CPA ensures you have the right insurance coverage to protect your franchise.

- Assessing investment risks: They evaluate potential investments so you can avoid high-risk opportunities.

- Compliance monitoring: A CPA ensures you meet regulations, reducing the risk of any legal issues.

A CPA also guides you through financial forecasting – here’s how.

- Projecting cash flow: They estimate future cash flow, helping you prepare for slower periods.

- Budget planning: A CPA creates a realistic budget that aligns with your growth goals.

- Sales forecasting: They predict sales trends based on past performance, allowing you to adjust your strategy.

- Expense analysis: A CPA reviews your expenses to find the best ways to save money.

Franchise Accounting: Identifying Hidden Costs in Your Franchise

When it comes to franchise bookkeeping, many expenses can go unnoticed, but a CPA can help you find and manage them. With their guidance, you can better understand where your money is going and adjust your budget.

Here are some possible hidden costs in your franchise that you may have overlooked.

- Other fees: Beyond the initial fee, ongoing royalty and marketing fees can add up.

- Employee turnover: High turnover can lead to extra training and recruitment costs.

- Equipment maintenance: Regular maintenance and repairs for equipment can be more costly than expected.

- Utility costs: Small changes in utility prices can impact your expenses, especially if not monitored closely.

- Compliance fees: Failing to meet regulations can lead to fines or penalties.

- Insurance premiums: Insurance costs can increase over time without careful review.

- Marketing expenses: Unexpected local marketing efforts or promotional costs can strain your budget.

- Supply chain fluctuations: Changes in supplier pricing or delays can increase costs.

- Technology upgrades: Keeping software and systems up-to-date can add up.

- Unexpected legal fees: Disputes or issues with contracts can lead to legal costs.

A CPA helps you uncover all of these hidden expenses so you can plan better and reduce unnecessary spending.

A CPA Can Help You With Accurate Franchise Business Asset Valuation

The true value of your assets includes everything from equipment and inventory to property and intangible assets like your brand.

A CPA uses their franchise accounting expertise to assess the market value of each asset. This can be important if you want to sell your franchise, apply for a loan, or expand your business.

They ensure that your assets are properly recorded in your financial statements, which helps you present a clear picture of your business’s worth to potential investors or lenders.

Asset valuation also plays a role in tax calculations. A CPA who does your franchise bookkeeping makes sure that your assets are depreciated correctly so you don’t end up paying more taxes than necessary. They help you identify assets that may have lost value over time and adjust their worth accordingly.

Having an accurate understanding of your assets allows you to plan for the future more effectively. With a CPA’s guidance, you will gain a much clearer view of your business’s true value.

And there you have it! We hope you can see just how valuable an expert CPA can be for your franchise business.

So when it comes to franchise bookkeeping, always consult with a professional…a CPA, when needed – the benefits far outweigh the drawbacks. We wish you continued success for many years to come!

(Guest Contributor, Ravi S. Patel, CPA, is the CEO of Cambrean CPA based in Alpharetta. With a Bachelor of Science in Accounting from Fairleigh Dickinson University Silberman College of Business, Ravi founded his company to provide trustworthy and expert financial guidance. He is dedicated to helping businesses of all sizes thrive.)

About the Author

The Franchise King®, Joel Libava, is a leading franchise expert, author of "Become a Franchise Owner!" and "The Definitive Guide to Franchise Research." Featured in outlets like The New York Times, CNBC, and Franchise Direct, Joel’s no-nonsense approach as a trusted Franchise Ownership Advisor helps aspiring franchisees make smart, informed decisions in their journey to franchise ownership. He owns and operates this franchise blog.

Note: When you buy through links on this website, we may earn an affiliate commission.